Paramount Insurance Brokers

What Are Medicare Supplements?

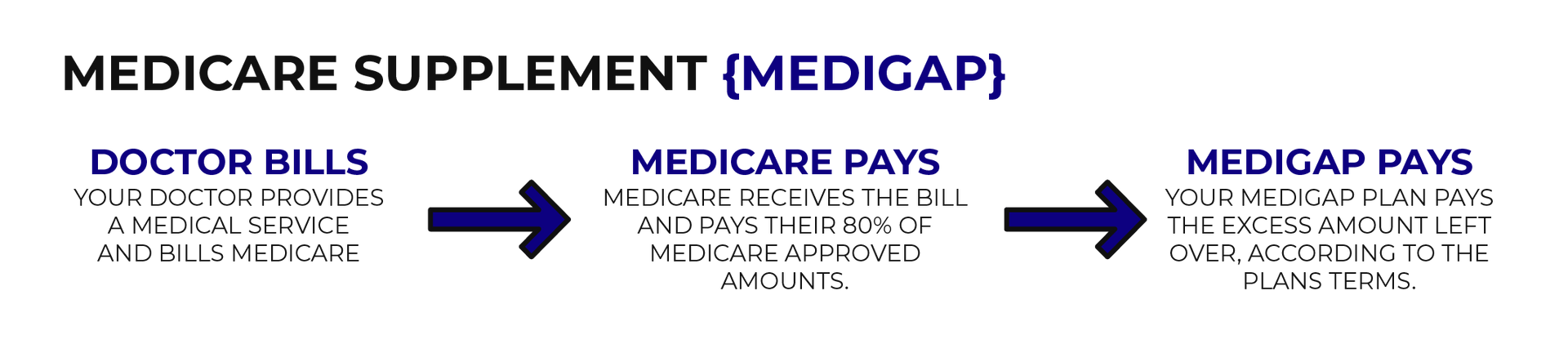

Medicare Supplements, also known as Medigap policies, are sold by private insurance companies to help you cover the out-of-pocket costs left behind by Medicare.

When you have a Medigap policy, Medicare pays up to its limit on your medical expenses. Then your Medicare Supplement Plan will kick in, up to it’s limits. That limit usually is able to pay off the remainder. However, that will depend on which policy you select.

FREQUENTLY ASKED QUESTIONS